Routing numbers are also known as banking routing numbers, routing transit numbers, RTNs, ABA numbers, and sometimes SWIFT codes . Routing numbers differ for checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers. Usually all banks have different routing numbers for each state in the US. You can find the routing number for Wells Fargo Bank, National Association in Alabama here. When you pay your First Citizens credit card bill online from a First Citizens account, any payment funds transferred before 9 pm ET are credited the same day.

Your updated account balance and availability of funds could take 2 business days. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust.

Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. You can transfer money to your First Citizens checking accounts, savings accounts, money market accounts, credit cards, consumer loans and lines of credit.

A transfer to your First Citizens credit card is credited the same day. Your transfer could take 3 to 4 business days to post to your credit card account. An overdraft occurs when money is withdrawn from a bank account that doesn't have enough in its available balance to cover the transaction. If you have premium overdraft protection set up on your checking account, such as linking it to savings or Checkline Reserve, funds from these services may be used to cover an overdraft. Additionally, overdrafts may be covered by our basic overdraft protection with ATM and debit card coverage. A routing number is a nine-digit code to identify your financial institution.

This may also be called an American Bankers Association routing transit number . You will need the routing number for transfers, wire transfers and direct deposit. They help identify the specific financial institution where money is coming from or going to when sending and receiving money between banks.

For instance, the Federal Reserve banks use routing numbers to process Fedwire transfers. At the same time, the National Automated Clearing House needs them to process electronic funds transfers like debit/credit card or check transactions. Routing numbers enable financial institutions to track where funds originated and where they're going. Routing numbers are required for financial institutions to process transactions like direct deposits, check deposits, loan payments, and wire transfers. Everyday banking tasks like direct deposit, bill payments, check processing, wire transfers, and the use of mobile payment services like Venmo require an account number and routing number. Let's take a closer look at what a routing number is and how it works.

The ABA routing numbers are useful only for ACH transfers. Businesses in the Accelerated Rewards Tier have access to additional experiential rewards and a fixed point value airline travel reward. You can use Digital Banking to manage your free checking account online.

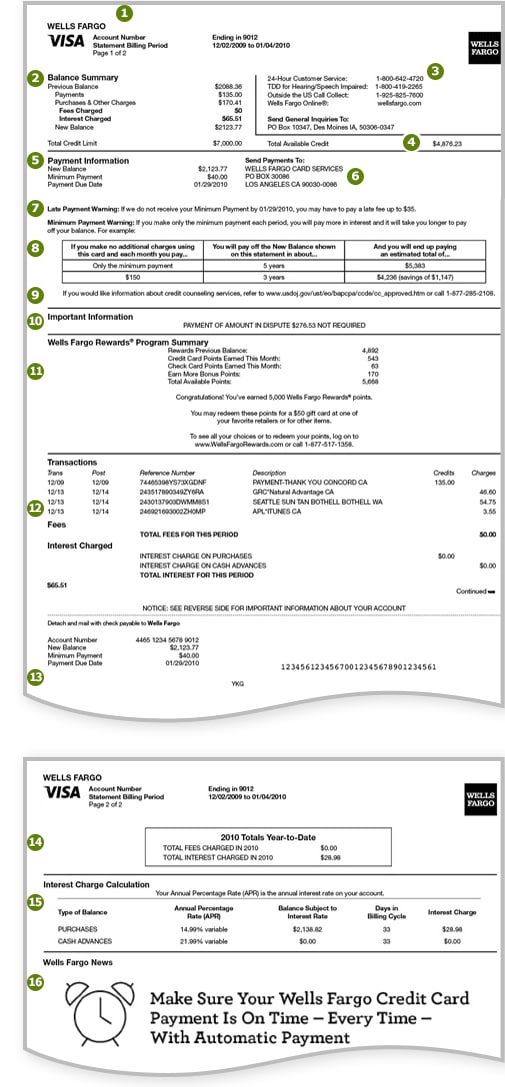

Easily track your transactions, set up budgets, transfer money and make payments all in one convenient place. Download the First Citizens mobile banking app to manage your account and deposit checks on the go. Wells Fargo is one of the largest banks in the US and beyond, and thus, has multiple ABA routing numbers that vary from state to state.

Your Wells Fargo ABA routing number is based on the state where you first opened your account and very vital when sending/receiving ACH transfers within the United States. Unlike the ABA routing numbers, there is only one routing number for domestic wire transfers and one SWIFT code for international wire transfers to and from the US. When sending a wire transfer, take time to confirm all the details with the recipient or your bank before you send. It's especially true for the routing number and account number. If you get them wrong, the funds will either go to the wrong financial institution or the wrong recipient.

The same case applies when sending a wire transfer to a recipient cross-border. They'll need to provide their bank routing number, account number, and account name to receive the funds. Please allow two business days for your payment to be applied to your account after you submit it. It's a fast, safe and easy way to send money to friends, family and associates in minutes1, right from the WaFd Bank mobile app or online banking.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. The Wells Fargo international wire transfer routing number is WFBIUS6S. It's because SWIFT codes are used to identify financial institutions worldwide.

This number is different from any bank account numbers the cardholder may have. That's because many people hold credit cards from financial institutions outside of their banks. Assigning a unique credit card number makes it easier to replace a lost or stolen credit card without affecting the cardholder's bank account, and it can also help prevent fraud. A routing number is a nine-digit number assigned to a bank or credit union. Think of it as your bank's numerical address that allows it to send and receive money from other financial institutions.

Also known as a "routing transit number" or ABA number, your routing number identifies the specific U.S. bank you do business with. Each account holder should enroll individually in First Citizens Digital Banking. However, both account holders will see the joint account on digital banking.

Once the payments post, both customers can see them in the list of posted transactions on the account. Overdraft protection is an account management tool designed to help you cover a transaction when you don't have sufficient funds in your checking account. Eligible transactions may include checks, ATM withdrawals, debit card purchases, wires and electronic transfers. With overdraft protection, we'll cover a shortfall at our discretion so the transaction goes through successfully. Credits are deposits or transfers of money into your account. On Monday morning, Sally's checking account has an available balance of $5.

At 9 am, she makes a $75 debit card purchase at a local retailer. At 1 pm, she realizes that she doesn't have enough funds in her account to cover her morning purchase. Sally logs in to Digital Banking and transfers $100 from her savings account to her checking account.

A routing number is a nine-digit code used to identify specific financial institutions in the United States. If that isn't available, ask your bank or credit union for one. We've included a list of forms from top banks, including the Capital One and Bank of America direct deposit forms. A routing number is a nine-digit numeric code printed on the bottom of checks that is used to facilitate the electronic routing of funds from one bank account to another.

It's also referred to as RTN, routing transit number or bank routing number. Now you'll see the routing number for direct deposits, electronic payments, and domestic wire transfers. A routing number, also called the ABA routing transit number , is a nine-digit code that indicates the financial institution you bank at. They are unique to each bank and allow the accurate transferring of money between financial institutions. SWIFT serves as the messaging system that enables a worldwide network of financial institutions to exchange funds. It is used internationally and for money transfers that cross national borders.

SWIFT codes are often used when initiating wire transfers both from another country to the U.S. and from a U.S. bank to one in another country. Get routing numbers for Wells Fargo checking, savings, prepaid card, line of credit, and wire transfers or find your checking account number. A free checking account lets you safely and easily deposit and withdraw money for everyday purchases. You can use personal checks or a debit card to spend your money, buy groceries and gas, pay bills, and get cash from ATMs. When you open a checking account, you're also required to opt in or out of basic overdraft service with ATM and debit card coverage. This enhanced service adds coverage for ATM cash withdrawals and one-time debit card transactions.

We don't authorize or pay overdrafts for these types of transactions unless you opt in to this service. If we don't authorize or pay an overdraft, your transaction will be declined. You can change your overdraft preferences for these types of transactions at any time. Since each bank has a unique routing number, funds can be accurately sent and received between banks. The routing number shows which bank a financial transaction is coming from and where the money is going.

That means if you use the wrong routing number, your money will be sent or received to the wrong financial institution or branch. The best bank accounts for kids include features that help you teach them about money management, earning interest, and more. Here are the details regarding some of the best checking and savings accounts for getting your kids on the path to great money management in adulthood. The clearinghouse is the designated financial intermediary that validates and finalizes transactions between a buyer and a seller. ABA routing numbers encompass all routing numbers, including ACH. Developed by the ABA, each routing number is publicly known and unique to one financial institution.

However, one bank or credit union may have multiple routing numbers that are specific to different locations and various tasks that are being completed. Keeping your money and information safe is a top priority for First Citizens Bank. When you use Zelle within our mobile app or online banking, your information is protected with the same technology we use to keep your bank account safe. Zelle is a fast, safe and easy way to send money directly between almost any bank account in the US, typically within minutes.

With just an email address or US mobile phone number, you can send Zelle payments to people you trust, regardless of where they bank. You can transfer money instantly to another First Citizens customer as long as they are also a Digital Banking customer. Select Payments and Transfers from the left navigation menu, then select Pay Bank Customer. You'll need to have the recipient's account type, email address associated with their Digital Banking account and last four digits of their account number.

Once the account is linked, it will appear under transfer funds as an account you can make transfers to. A credit card balance transfer is the process of transferring debt from one credit card to another. Usually, people use balance transfers to save money by moving from a high-interest rate card to a low-interest rate card, or to streamline monthly payments.

The new credit card may offer other benefits as well, such as a cash back or travel rewards program. To receive funds in your Elevations Credit Union account via wire transfer†, you'll need to provide the following information to the financial institution sending the wire transfer. Direct deposit is a free electronic transfer service that sends your paychecks or benefit checks to a bank account or prepaid debit card of your choosing. 4Touch ID is available only for newer iPhone models using iOS 8 or higher. Use of your Mobile device requires enrollment in Online Banking and download of our Mobile App.

Wireless carriers may charge fees for text transmissions or data usage. Mobile Banking requires an internet-ready phone and is supported on Apple iPhone devices with iOS 9 and greater and on Android mobile devices with OS 5 and greater. Mobile deposits made before 7 pm PT will be processed the same business day and made available within two business days. Longer delays may apply based on the type of items deposited, amount of the deposit, account history or if you have recently opened your account with us. An account number is a unique string of numbers, letters, and other characters that identify a specific financial account.

Almost all financial transactions make use of account numbers. Examples of account numbers include routing numbers and credit card numbers. You can open a new savings account with these online banks' low $100 minimum opening deposit requirement and it's as simple as that. WELLS FARGO BANK NA routing numbers have a nine-digit numeric code printed on the bottom of checks which is used for electronic routing of funds from one bank account to another. There are 1 active routing numbers for WELLS FARGO BANK NA .

Businesses may redeem reward dollars for cash back to a First Citizens checking or savings account or credit card statement credits and Pay Me Back statement credits. Zelle does not accept debit cards associated with international deposit accounts or any credit cards. You can pay bills from any First Citizens checking account listed on your Accounts page within Digital Banking. When you access Bill Pay for the first time, you will be asked to select a Pay From Account to begin.

If you would like to add another checking account to the service, select My Account within the Bill Pay service, then select Add Account from the Pay From accounts box. Overdraft protection, including basic overdraft service with ATM and debit card coverage, is set on an account-by-account basis. This means you decide how you'd like overdrafts to be handled for each account that you have. If you want overdraft protection on more than one bank account, then you must enroll each one. Debits are withdrawals or transfers of money out of your account.

Some examples of debits are writing a check, using your debit card to withdraw funds or make a purchase, or initiating an outgoing online transfer from your account. First Citizens direct deposit service offers you the convenience of recurring automatic deposits into your accounts with same-day access. Deposits can be distributed across multiple First Citizens accounts. Online alerts let you know when your money has been deposited. To find your ACH routing number, first check your checkbook. It may be the nine-digit number to the left of your account number.

ACH is an electronic money transfer system that lets individuals receive or send payments via the Federal ACH network of banks in the United States. Find your account number by signing into online banking, checking your bank statement or looking at the bottom line of your printed checks. You may also contact your local branch for further assistance. Find this on your bank statement or your financial institution's website.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.